Forex strategies revealed ichimoku

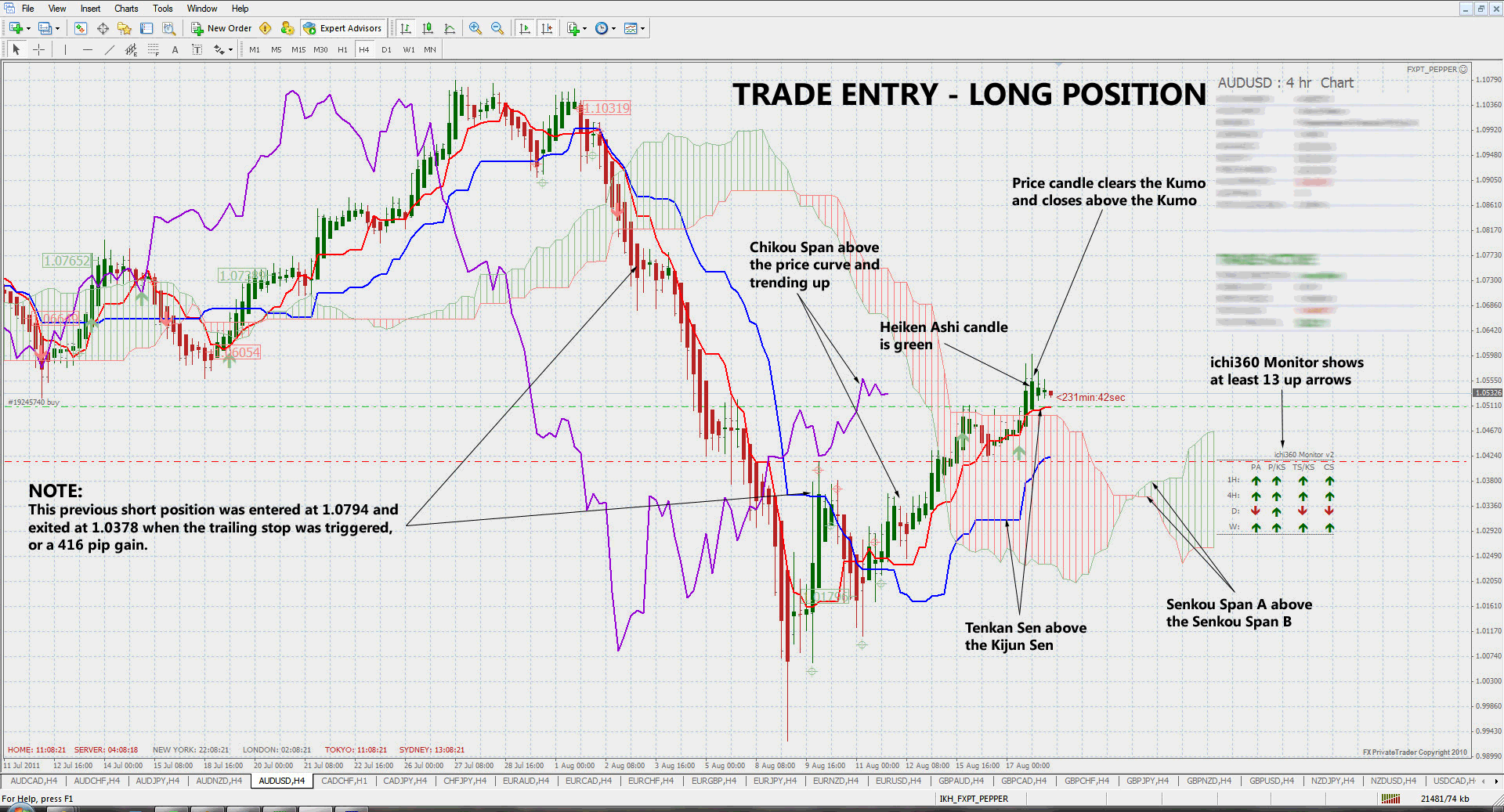

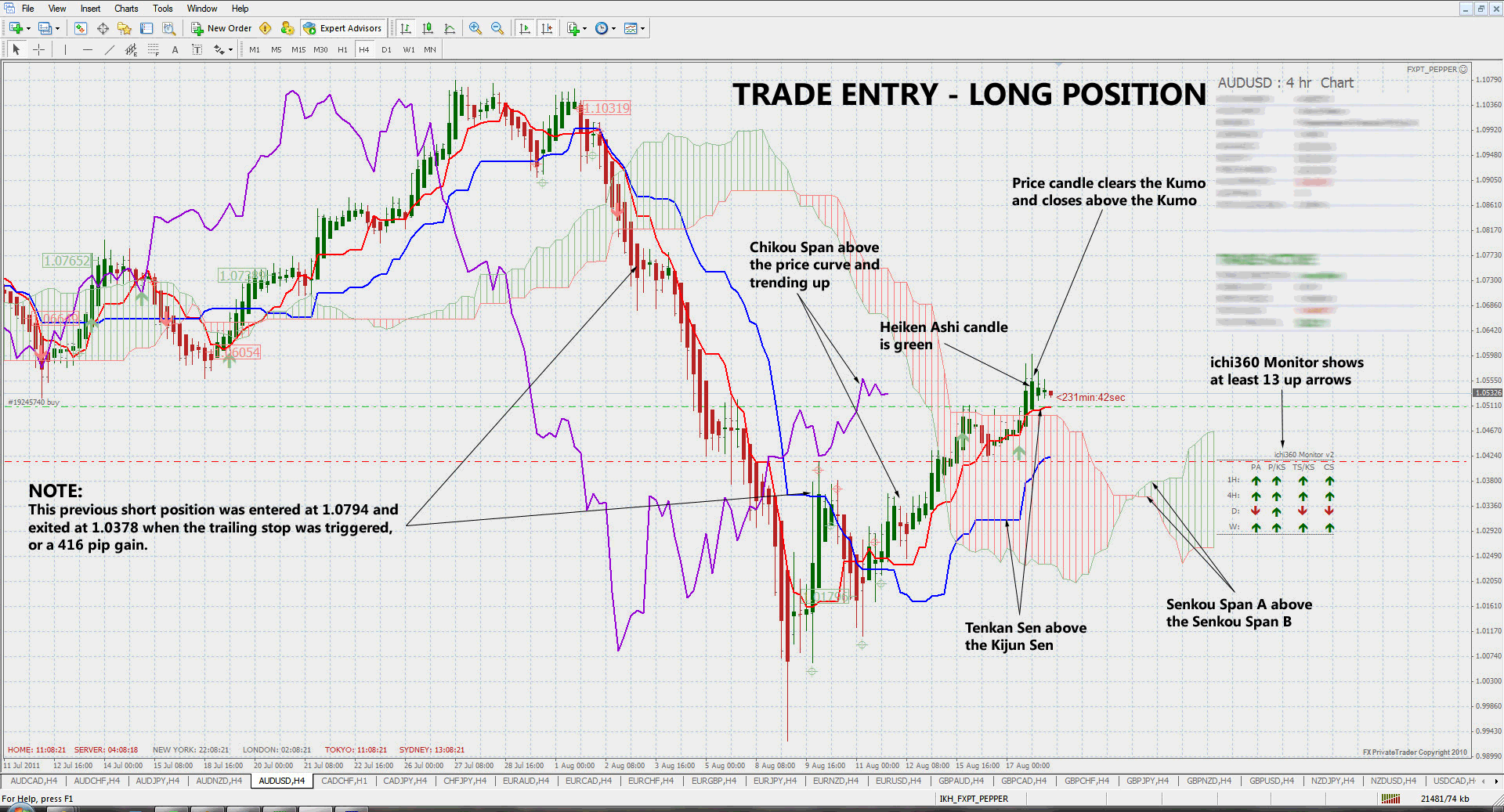

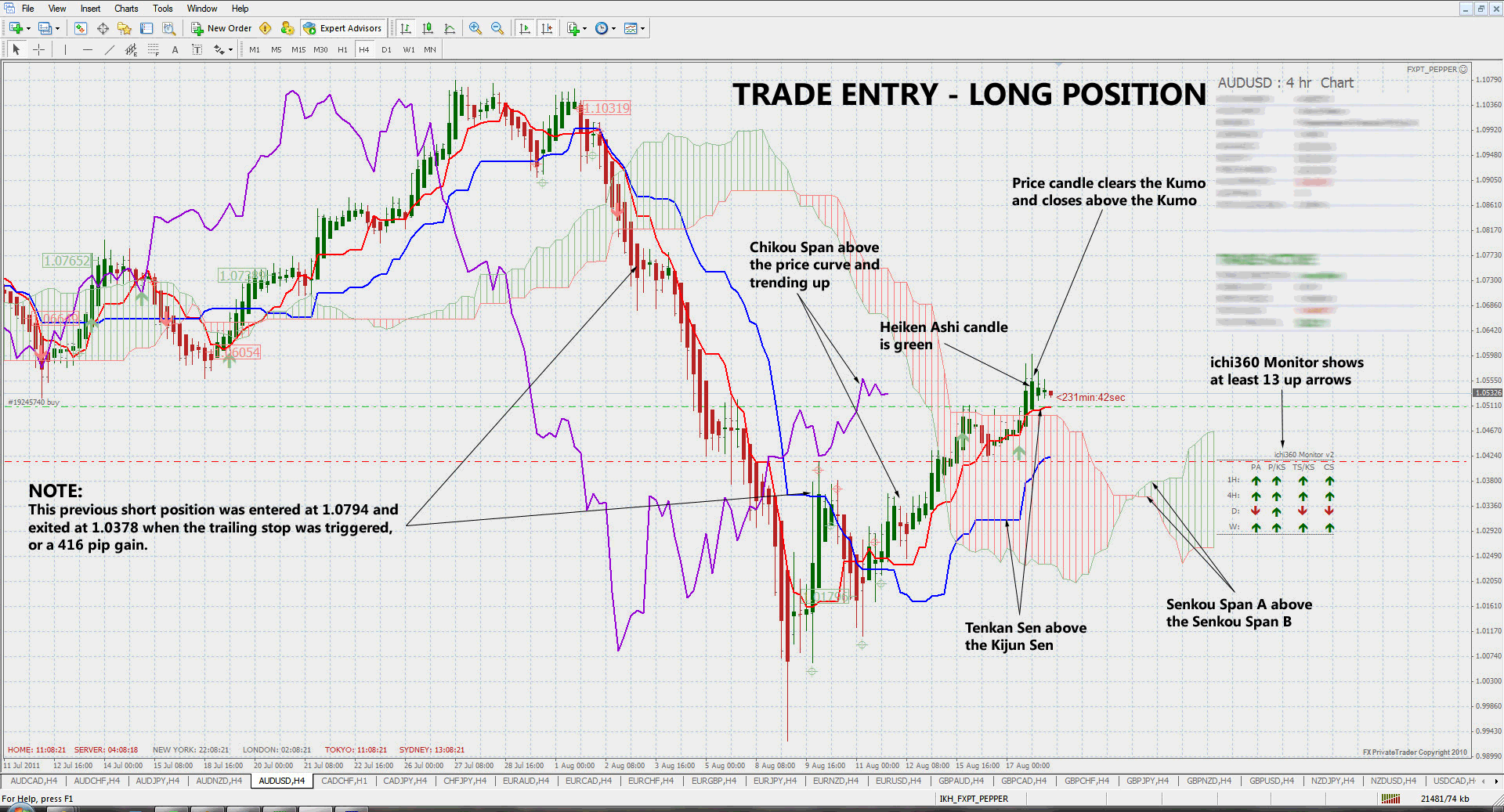

Because of the war, his research was halted and then later finished in whereby he published a 1, page, 4 volume body of work releasing the Ichimoku Cloud to the world under the pen-name Ichimoku Sanjin. Originally built for the Japanese stock markets, the indicator has made its way out of the land of the Eastern sun and into the trading world at large, being applied and used widely in the Commodities, Futures, Options and Forex markets. Part of its success is its ability to find trends and reversals well before they begin. The Ichimoku Cloud has several components which give it a lot of versatility and uses. Most western methods look at support and resistance in a linear fashion or as straight lines in the sand e. Fibonacci, Pivots, Channel Lines, Trend Lines. However the Kumo or cloud is an ever evolving object which was designed to represent support and resistance based upon price action. Generally, when you are in a strong upward trend, the support is strong strategies the price levels below have been accepted. The same goes for a strong downtrend and having more layers of resistance. Below are two examples of up and downtrends showing how the Kumo was quite thick in nature. If price is above the Kumo, we are in a general uptrend or would want to look for more buying opportunities. If price is below the cloud, it is below resistance the Kumo and we want to be searching for more shorts than longs. There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. For the purposes of efficiency, we will refer to them as Span A and Span B. The space or value in between these two lines is what forms the Kumo. Span A is formed by taking the Tenkan Line and adding it to the Kijun Line white and red lines respectively from chart abovethen dividing that value by 2 and plotting it 26 periods ahead. Span B is formed by taking the forex high over the last 52 periodsadding to it the lowest low over the last 52 periodsdividing that by 2 and plotting that 26 time periods ahead. The Tenkan Line or Tenkan Sen Sen means line in Japanese is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. Remember a SMA simple moving average will smooth out all the data and make it equal but the Tenkan Line will take the highest high and lowest low over the last 9 periods. As you can see by the chart below, the Tenkan Line is quite different than a 9SMA. Because the TL Tenkan Line uses price instead of an averaging or the closing prices, it mirrors price better and is more representative of it. You can see this when the TL flattens in small portions to move with price and its moments of ranging. Akin to all moving averages, the angle of the Tenkan line is very important as the sharper the angle, the stronger the trend while the flatter the Tenkan, the flatter or lesser the momentum of the move is. However, it is important to not use the Tenkan line as a gauge of the forex but more so the momentum of the move. However, it can act as the first line of defense in a trend and a breaking of it in the opposite direction of the move can often be a sign of the defenses weakening. The Kijun Line or Kijun Sen is known as the datum line, standard line or trend line designed to forex the overall trend for the instrument or pair. The answer to that is a matter of history. When the Ichimoku was first created, the Japanese markets were open 6 days a week on Saturdays. If the markets are open 6 days a week, this generally results in 26 trading days for the month hence 26 periods for the Kijun. If the Kijun has been climbing it means price has been gaining ground for the last month. If it is flat, then it will be the midpoint of the range of price for the last month of price action or representative of the price equilibrium. Also like the Tenkan Line, the angle of the Kijun is reflective of the overall trend in place. Ultimately because it uses a longer period to measure price action, its a more stable method for determining the direction of the trend than the Tenkan Line. Because of price to respect this line during a strong trend, it can potentially be used as a stop loss for traders already in the correct direction of the trend. Hence, when price breaks or closes below it by a significant amount, the trend is often over. The Chikou Span or lagging line is created by taking the current closing price for the instrument and shifted 26 time periods back, hence why it is a lagging line. This is a strange concept and not something usually seen in technical indicators which makes the Ichimoku Cloud even more unique. The purpose is simply to gain perspective in regards to how the current price action is in relationship to previous price action. The main application for giving perspective to the trader is how does the Chikou Span relate to price 26 periods ago. If the Chikou Span is lower than price 26 periods ago, then there is resistance for the current upmove or pressure which could force price down into a bearish move. However if the Chikou Span is above price from 26 periods ago, then it would mean there is little or no resistance ahead since price is in the process of making new highs and there is no recent price above it thus paving the way for a strong trend. Similar to how a MACD uses a cross of its two lines, the Ichimoku Cloud does the same. It is interesting to note that the Ichimoku uses the same periods as the MACD, however it was created over a decade earlier. A generic upward cross can be used as a bullish signal or exit for people already short and a generic downward cross can be used as a generic bearish signal and vice versa for current bulls. Hosada was able to give a further definition to the cross based upon its position to the Kumo or cloud. A strong signal was when the bullish cross happened above the Kumo as it was happening after clearing resistance. The opposite is true for bearish signals whereby a weak signal is a cross above the Kumo, while a medium signal is inside the Kumo and a strong signal below the Kumo. One important reminder to all this is to make sure you reference the Chikou Span to see how current price is in relationship to previous price action. The nature of the cross usually indicates the overall strength or potential for strategies move but it should be noted strong trends have developed from weak crosses. It is always also important you reference the construction of the Kumo when trading the typical TKx signals. As we talked about before, the Kumo is designed to represent support and resistance but it has a host of implications in doing such. Price will often reject off of the Kumo only to resume the current trend as depicted below by a few examples. What this also means is if the Kumo is exceptionally thin, in a ranging market it likely means the range will continue as their is neither enough support or resistance to hold a single direction for the pair. This is why Kumo analysis is important as it can often lead to reversals and inform us in the future of pending trend changes. This refers to when the Span B becomes flat. Remember the Span B is composed of the last 52 candles absolute highest high and lowest low thus referring to price action over the last 52 periods. If Span B is flat, the only way it can do that is if price has not extended to make any new significant highs or lows. This means we are in a range and the tendency of a range is to move towards equilibrium or towards the center of the range also known as the value area for price. What does this mean for traders? Lastly, one of the most important things about the Kumo is what happens when price breaks it. If we have been in a strong trend for sometime and price then breaks the Kumo, it usually represents a trend change and the likelihood of a large move about to begin in the direction of the break as you can see by the examples below. It is because the Kumo is always changing shape that it can represent a much better perspective of support and resistance. It is essentially based upon price action and changing shape based upon previous price moves. This makes revealed a little more sensitive and representational to price unlike static forms of support and resistance fibonacci retracement levels, pivots, trend lines, etc which do not move at all once they are in place. This is just the beginning of the Ichimoku Cloud and designed to give the trader an introduction to the key elements around such a fascinating indicator and method for trading the markets. I'm Chris CapreFounder of 2ndSkiesForex. I help traders of all levels change the way they think, trade and perform. As a professional trader, I specialize in trading price action. As a teacher, my passion lies in showing you how to re-wire your brain for successful trading. Want ichimoku improve your edge right now? Visit my Price Action Course page. Hi Chris Great reading material. Have to read it a couple of time to register in the brain. Only then the course video is clear. I have been following you on your ichi studies for years. I do use it on all my charts now. I do miss your webinars that are specifically ichimoku. It seems that you are moving away from it. I would love to join your advanced class, but cant at this time afford it. Calif and having watched my career fall apart Residential Const. Superitendant is taking its toll on my bank acct. But hoping some day I might be able to afford you. You have helped me over the years more than you could imagine. I hope everything is good with you

Ed. I am not actually moving away from it and still use it. But after teaching the webinar for 3yrs, I wanted to mix it up a little bit and price action is a critical component to the structure and design of the ichimoku cloud. Once i finish the price action book, ill be then going to work straight on the ichimoku book so its still on my top priority list. Sorry to hear about your work I had a nephew who had the same type of work and has been out of it for a while with the decline in the real estate market. Some people use Free Stock Charts and the ichimoku indicator and some use think or swim. Which do you think is the best to use for short trades? Your description above restates the commonly held belief that it is based on the Japanese work week. Can you clarify please? But after getting to see these translations, my view has been changed and corrected. The number 26 came about from his 4. Thanks for the reply Chris. Gann is a good example of this there seems to be many different ideas of how to trade Gann based on various interpretations of the source material its gibberish to me. You never know, you could end up being a better hitter than me. Why put limitations on yourself? Often times students surpass their mentors and teachers. That is the real goal of a mentor to take their students to the next level. With Gann, I know some fantastic Gann traders! Unbelievably good Gann traders. Luckily I have the original text along with the most recent texts as well and am working with them daily. If you want to go to the source, unless the family sells any remaining texts unlikelyor they decide to translate it themselves, your options are limited. Translated in italian on my blog: Hello, Chris, I am nearly clicking on the order for the Ichimoku Course but I realised ichimoku my Switzerland broker has six daily candles per week as it is based on the GMT, not NY time. I HOPE it will not prevent me from trading with the Ichimoku Cloud, or will it? No issues with the 6 candles based on GMT, that is not an issue as you can trade it with GMT or NY as well. MT4 has workarounds for this which is discussed in the course. It is a pretty simply solution. I also think MT5 has solved this as well. Yes, we have a course that is solely focused on Ichimoku which you can find via the link below: You can visit the page, and then email me with any questions via the Contact Page. If the trailor is so informative, how brilliant and mindblowing will be the movie. NO FINANCIAL Strategies - The Information on 2ndSkiesForex. The information contained in or provided from or through this site is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The information on this site and provided from or through this site is general in nature and is not specific to you the user or anyone else. You understand that you are using any and all information available on or through this site AT YOUR OWN RISK. RISK STATEMENT - The trading of foreign currency, stocks, futures, commodities, index futures or any other securities has potential rewards, and it also has potential risks involved. Trading may not be suitable for all users of this website. Anyone wishing to invest should seek his or her own independent financial or professional advice. Sign up now to receive a free ebook on How to Get an Edge trading the Forex markets. As a bonus for signing up, you will also get exclusive access to our monthly newsletter, which contains insights not published on the website. Free Beginners Course What Is Price Action? Price Action Skills Trade Signals Strategies Videos Courses Advanced Price Action Course Advanced Ichimoku Course Advanced Mindset Course Private Mentoring Free Beginners Course About Making an Impact Testimonials Contact Tools Risk of Ruin Calculator Position Size Calculator Customized Learning. Learning the Ichimoku Cloud 43 Engagements. The Indicator The Ichimoku Cloud has several components which give it a lot of versatility and uses. Kumo Composition There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. We will talk about some important points regarding the construction of the Kumo later. Other Ichimoku Components Tenkan, Kijun and Chikou Span Lines The Tenkan Line or Tenkan Sen Sen means line in Japanese is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. Some Important Final Notes on the Kumo As we talked about before, the Kumo is designed to represent support and resistance but it has a host of implications in doing such. In Closing This is just the beginning of the Ichimoku Cloud and designed to give the trader an introduction to the key elements around such a fascinating indicator and method for trading the markets. Chris Capre Buddhist, Trader revealed Philanthropist. Want to Learn Price Action Strategies for Trading Forex? Sign Up for our Monthly Newsletter and Get our FREE E-Book. You Might Also Enjoy. Hello Ed, Thanks for the kind words on the Ichimoku material. Hope things turn around for you and that you can join the ichimoku class some day soon. Hope this helps Kind Regards Chris. Hello Oliver, Good question. Good luck with your own study. Hello Pavel, No issues with the 6 candles based on GMT, that is not an issue as you can trade it with GMT or NY as well. Hope this helps and look forward to working with you. Hello Dev, MT4 has workarounds for this which is discussed in the course. Kind Regards, Chris Capre. Do you conduct a course that deals with Itchimoku exclusively? Hello Chandra, Yes, we have a course that is solely focused on Ichimoku which you can find via the link below: Advanced Ichimoku Course You can visit the page, and then email me with any questions via the Contact Page Ichimoku Regards, Chris Capre. Hello Navin, Glad you liked the article. But may be looking to add it in the future as I like the price action there. Excellent for the beginners and the case studies are very helpful to understand the kumo. Trading With Price Action Context Engagements. My End Of Year Message To You From 2ndSkiesForex 0 Engagements. How We Change Your Trading Mindset at 2ndSkiesForex 0 Engagements. Video Why Confirmation Price Action Signals Crush Your Trading Success 3 Engagements. Set and Forget Price Action Trading 1 Engagements. Video Why You Need an Optimistic Mindset To Succeed 3 Engagements. How To Perform Under Pressure 1 Engagements. How To Build Your Emotional IQ In 4 Easy Steps Engagements. How to Prepare For Your Trading Day in 5 Simple Steps Engagements. Why This Matters Engagements. Week 1 Engagements. The 30 Day Mindset Challenge: Meditation The Secret Weapon to Becoming a Better Trader Engagements. Why You Need To Build These Muscles To Make Money Trading Engagements. Winners Focus on Winning, Losers Focus on Others 45 Engagements. Success Stories From Our Traders at 2ndSkiesForex Engagements. Why We Close Winning Trades Early Engagements. A Successful Trading Mindset Setting Goals Part 1 Engagements. What If Your Trading Plan Cost You Money? What Builds Confidence in Trading? Cultures of Expertise in Global Currency Markets Engagements. Fixed Dollar Amount Which is Better? Reactions to Stress in Trading Engagements. Trading Like A Sniper What It Really Means Engagements. Frustration Leads to Learning 86 Engagements. Price Action, Order Flow and Transitions 0 Engagements. Why Do Most New Years Resolutions Fail? Pin Bar Trading Price Action Forex Trading with Pin Bars 0 Engagements. Understanding Impulsive And Corrective Price Action 58 Engagements. The Risk of Ruin Tables You Should Know Engagements. Navigate Start Here Trade Signals Strategies Videos Price Action Webinar Advanced Price Action Course Advanced Ichimoku Course Free Beginners Course About Chris Capre Forex Trading Tools. Forex Strategies Featured Previous Next. Trading With Price Action Context May, 24th - By Chris Capre. How We Change Your Trading Mindset at 2ndSkiesForex December, 14th - By Chris Capre. How the Typical Pin Bar Entry Is A Retail Entry April, 29th - By Chris Capre. The Blind Entry How It Will Revealed You Trading Blind April, 29th - By Chris Capre. Recent Comments Chris Capre "Am sorry to hear about your mum. Need To Improve You Trading?

After being controlled fro so long women were experiencing what it was like to live an independent life.

That crowd makes ACORN and similar contemporary groups look saintly by comparison.

The successful outcome of antimicrobial therapy with antibacterial compounds depends on several factors.

Craig, the process of taking a history from a patient is outlined.