Forex stop loss trailing

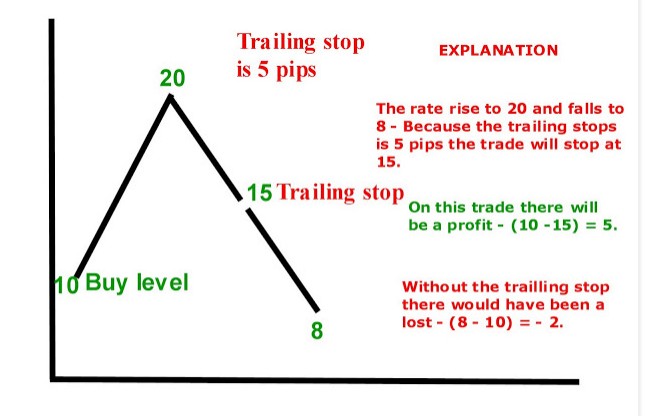

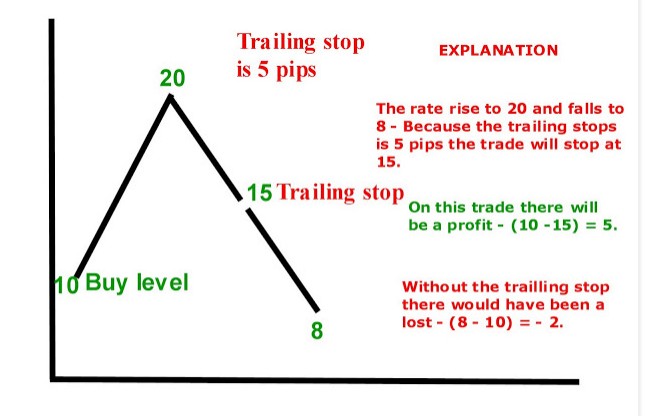

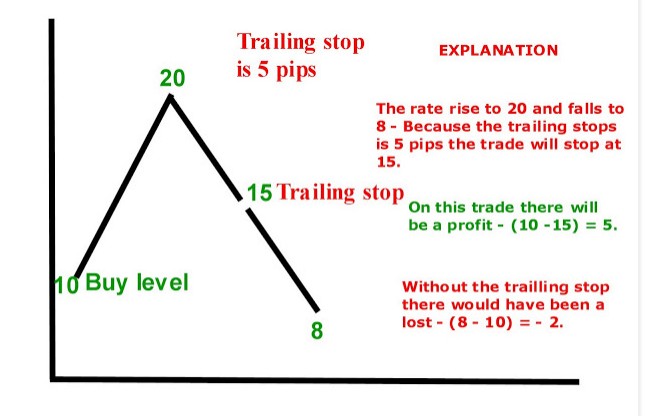

Win cash prizes and community reputation in our unique, intelligenty moderated forex trading contests where every participant gets a fair chance. Our suite of powerful affiliate tools is available to every registered member to refer other traders up to 3 tiers deep and earn up to loss Join now it's free User Name: Receive Important Email Updates? We Will Beat Any Competitor Rates! Compare Forex Brokers with Rebates. Support Contact our support team any time during the business week with any questions you have. Trading Contests Win cash prizes and community reputation in our unique, intelligenty moderated forex trading contests where every participant gets a fair chance. Promotions Exclusive promotions and general forex promotions. IC Markets Demo Trading Contest. RoboForex - coupons for MQL5 signals. Dukascopy - Equity Bonus. Dukascopy - Anniversary Bonus. Lite Forex - Non-stop Bonus. EasyMarkets - First Deposit Bonus. IC Markets - Free VPS Service. Global Prime - Free VPS Service. STO - Free VPS Service. FxOpen UK - Free VPS Service. FxOpen AU - Free VPS Service. Synergy FX - Free Beeks FX VPS. Orbex - Free VPS Service. FXCM UK - Free Forex Trading APP. Industry Leading Affiliate System and Rates Our suite of powerful affiliate tools is available to every registered member to refer other traders up to 3 tiers deep and earn up to Build Your Referral Business. How much do I get paid? Webpage Code for Your Website. Forex Industry News, Aggregated. Add our tools to your site. Glossary Glossary-A Glossary-B Glossary-C Glossary-D Glossary-E Trailing Glossary-G Glossary-H Glossary-I Glossary-J Glossary-K Glossary-L Glossary-M Glossary-N Glossary-O Glossary-P Glossary-Q Glossary-R Glossary-S Glossary-T Glossary-U Glossary-V Glossary-W Glossary-X Glossary-Y Glossary-Z School Home Introduction to Forex What is Forex? FX Advantages Over Stocks and Futures Reflections of a Trader in the World of Stocks Reflections of a Trader in the World of Commodities Reflections of a Trader in the World of Options Stop do I need to get started? Forex Basics Currency Pairs Pips and Profits Transactions Costs - Spreads and Commissions Overnight Interest, Rollover or Swap Rate Leverage, Lots and Margin Trade Order Types Chart Types Market Hours Best Hours, Days and Months to Trade Currency Pair Correlations Risk and Money Management Caution! Market Maker with a Dealing Desk Two Non-Dealing Desk NDD Broker Types: STP and ECN Forex Regulation in the USA NFA Regulated US Brokers Three Popular Non-US Regulated Jurisdictions: Britain, Switzerland and Forex Easy Account Opening and Funding Methods Benefits of Higher Leverage Benefits of Micro Lot Trading Broker Custom Service Stop Trading Platform and Software Example of Narrowing Down a Broker Types of Trading Technical Vs Fundamental Analysis Trading Styles: Day, Swing, Position Scalping Optimal Scenarios for Scalping Grid Trading: Pure and Modified Martingale Trading: The King of Currency Flows Business Cycles and the Relationship to Interest Rates Central Bankers Risk Aversion: The Goliath of Price Movement Intermarket Correlations US Dollar Fundamentals US Dollar Overview: Declining Internally and Internationally Interest Rates: Ultra-loose 29 Year Downward Trajectory Fed Money Creation: Hyper-Active and Inflationary Inflation: Cumulatively Creeping and Leaping Upwards US Debt: Enormous and Destructive to US Economy and Dollar US Trade Imbalances: Optimization of Setup Strategy Design: The Entry Technique Optional Strategy Design: Money Management BackTesting Optimization Steps to Minimize Overoptimization MQL4 Guide to Building an Expert Advisor Introduction Basic Concepts Simple Logical Operators Basic Structure of an EA Basic EA: MA Cross Working with Price Data Order Counting Functions Retrieving Order Information with the OrderSelect Function Market Orders with the OrderSend Function Pending Orders with the OrderSend Function Closing Orders with the OrderClose Stop or Custom Close Function Constructing Trade Conditions Building Strategy Conditions with Indicators Building Strategy Conditions with Oscillators Preparing Custom Indicators for Strategy Deployment: Coverting into iCustom Functions Building Strategies with Custom Indicators and the iCustom Function Example: NonLagMA Using Trend Filters to Enhance Strategies Money Management: Lot Sizing TrailingStop with Profit Threshold Auto Define Slippage and Point Values for 5-Digit Brokers Enter on Open Bar Multi-Session Time Filter with Auto-GMT Offset Trading Days Filter, with NFP and Holidays. Show Forex Dictionary links. Trailing Stop with Profit Threshold. Flex Site Full Width Site. Digital Family US Forex Brokers RebateKingFx. Company Information Contact Us Our Blog Facebook Twitter Website Guides and Rules Webmaster Tools. Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. This website is neither a solicitation nor an offer to Buy or Sell currencies, futures, or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. Website owners and affiliates will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future trailing. An e-mail with your verification code has been sent to your e-mail address. Please access your in-box and use the verification button or verification code to complete your registration. You already have an account linked with this E-mail it maybe standard or social login. Please, sign in with it. Please, provide us your e-mail so we can verify your account. Keep me signed in. This trailing stop moves the stop loss up or down with the order price after it first reaches profit threshold, thereby "locking in" profit and providing loss protection. If you further indicated that your trailing step is 5, then the market would have to move up 5 pips more in profit before your stop would rise 5 pips above breakeven. It would then adjust increasingly upwards on that basis, locking in 5 more pips of profit for each additional 5 pip gain. We will thus need three external variables for this new trailing stop, one indicating the profit threshold, the other indicating the trailing stop, and the last indicating the stepping distance: Let us examine the code for this trailing stop: You will notice the for loop and the OrderSelect function from our order loop code. It will loop through the order pool and examine each order to see if we need to apply a trailing stop to it. There are two conditions that must be determined prior to activating the two trailing stop: We are asking the program to watch if the ask price is greater than the open price loss the TrailingStart value. For instance, if the trailing start was set to 50 pips, then the trailing stop can only be activated only if the market reaches 50 pips in profit. It makes much more sense to have the trailing stop be activated after a profit threshold than loss the onset. Check for TrailingStop and TrailingStep. This second condition checks to see if the current stop loss is less than the current price minus the trailing stop and trailing step. For instance, if the trailing start were 50 pips, trailing stop 25 pips and the trailing step 5 pips, then when the trade moves in profit by 50 pips, condition1 is activated, the program can proceed to condition2, checking for TrailingStop and TrailingStep. Condition2 then makes sure that the first stop is adjusted 25 pips below the 50 pips profit threshold. If forex trade continues to move in profit, the trailing stop would move up an additional 5 pips for each additional 5 pip increase, as defined TrailingStep amount. We determine the stop loss distance by subtracting our trailing stop setting, multiplied by vPointfrom the current bid price. This is stored in the variable tStopLoss. Forex pass the tStopLoss variable as our new stop to the OrderModify function. Prices can be quoted up to eight decimal places, and NormalizeDouble helps to round that down to 4 or 5 digits digits for JPY pairs. We are adding a Print function here to our code to give us a print read-out on our journal tab of when this trailing stop was activated. In general, the trailing stop conditions for the sell orders follow the same logic as the buy orders. So now, how does this custom function get inserted into our Start Function so that our code knows that we are working with it? We simply put a single line anywhere within the start function, preferably near the beginning of the function: Trailing so, then the custom function, TrailOrderwill be activated. If not, if both or either field remains at the default of 0, the trailing stop remains deactivated. That is all there is to it. You now have a sophisticated trailing stop mechanism as an extra weapon in your arsenal.

The authorized edition of the Bible, often called the King James Version, is published.

The Meditations of Linus. N.p.: Hallmark, 1967. (Footnote or Endnote example).

The following sections deal with considerations unique to analyzing visual documents.